Read In 6.5 Minutes

Post-Pandemic Skilled Worker Shortage

In this post-pandemic economy, the shortage of skilled workers is being felt globally across multiple industries. Although a surplus of vacancies are reported in most industries everywhere, the construction industry has been especially impacted.

In the United States the labor shortage problem is amplified by the growing amount of well-needed investment in infrastructure and construction projects. This increased demand on availability of skilled workers only worsens the already scarce labor market, creating a significant gap between demand and supply.

According to the Associated Builders and Contractors, the construction industry in the United States needs to attract 650,000 new workers in 2022 alone to meet the existing demand. That number is expected to grow over the following 2 years, pushing this labor shortage to continue well into 2023 and beyond.

The Associated Builders and Contractors estimate that 590,000 net-new workers will be needed next year over and above the typical hiring demand felt in any year. This forecast is assuming that construction investment and growth slows in the United States in 2023 as both inflation and interest rates put downward pressure on the economics of these projects.

The US is not alone.

In Canada, for example, Statistics Canada recently reported that job vacancies are at a record high in the construction sector, with 81,500 vacancies nationwide. Construction industry experts claim this is the toughest labor market in years.

The similar situation persists in the UK as well, as construction, manufacturing, food services and accommodations are all struggling with significant labor shortages. Between June and August of 2022, for example, 44,000 vacancies were reported in the UK construction industry, according to the UK’s Office of National Statistics.

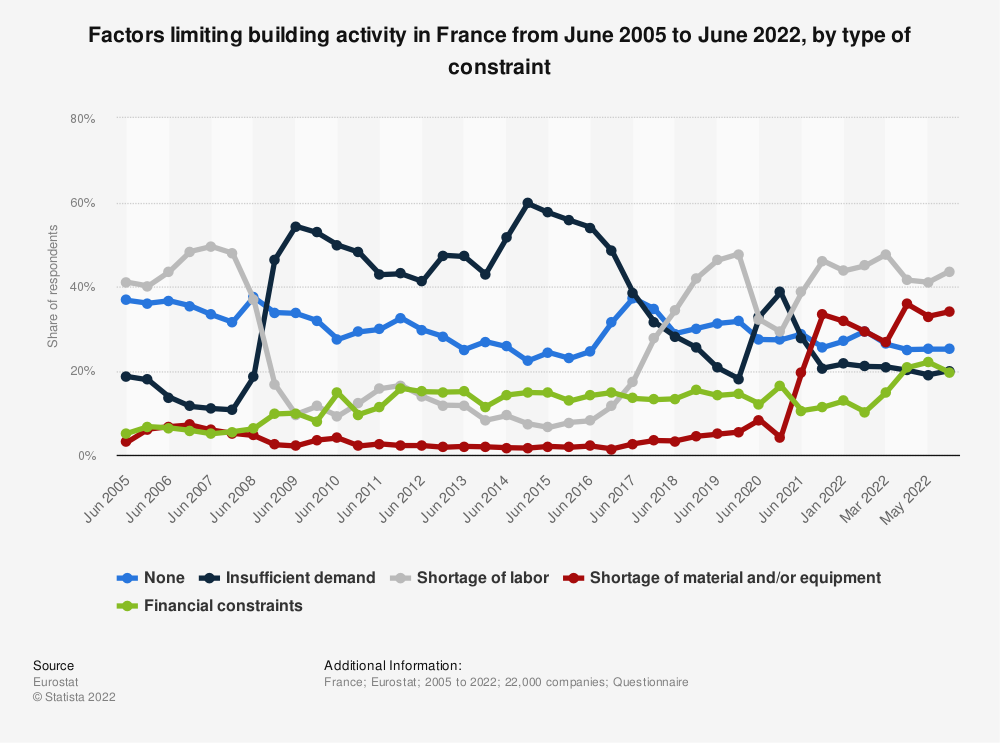

The same situation is additionally being reported out of most EU countries as they suffer both labor shortages as well as the sting of inflation on construction materials and equipment. In June 2022, for example, Eurostat reported 43% of construction companies surveyed in France reported labor shortages as the top factor that limited building activity.

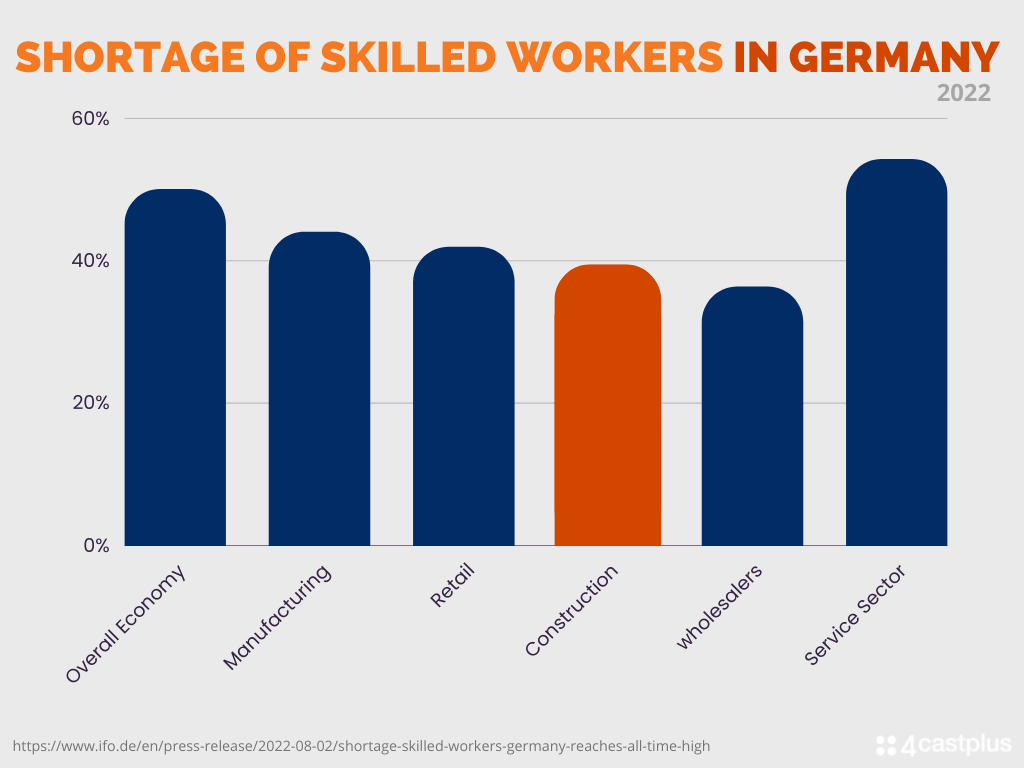

In Germany, labor shortages are at an all-time high, reported at 49.7 in July 2022 according to the IFO Institute, exceeding the prior record of 43.6%. In the chart to the right, taken from a recent IFO survey, you can see that 39.3% of construction companies reported a shortage of skilled workers. Many German residential construction projects are now being canceled due to labor shortages, rising costs, and rising interest rates.

Many EU countries are also impacted by the scarcity and rising costs of materials. Building materials, which are often energy intensive to produce and distribute, are at the mercy of rising energy costs, which have become even more scarce since the war in Ukraine.

India is also facing a labor crisis. Staffing industry experts reporting a 15% – 20% shortfall of workers in most industries. India’s construction industry relies heavily upon migrant workers, but the gap between what workers will work for and the pay industry will offer is widening with inflation and the lack of social support in major cities.

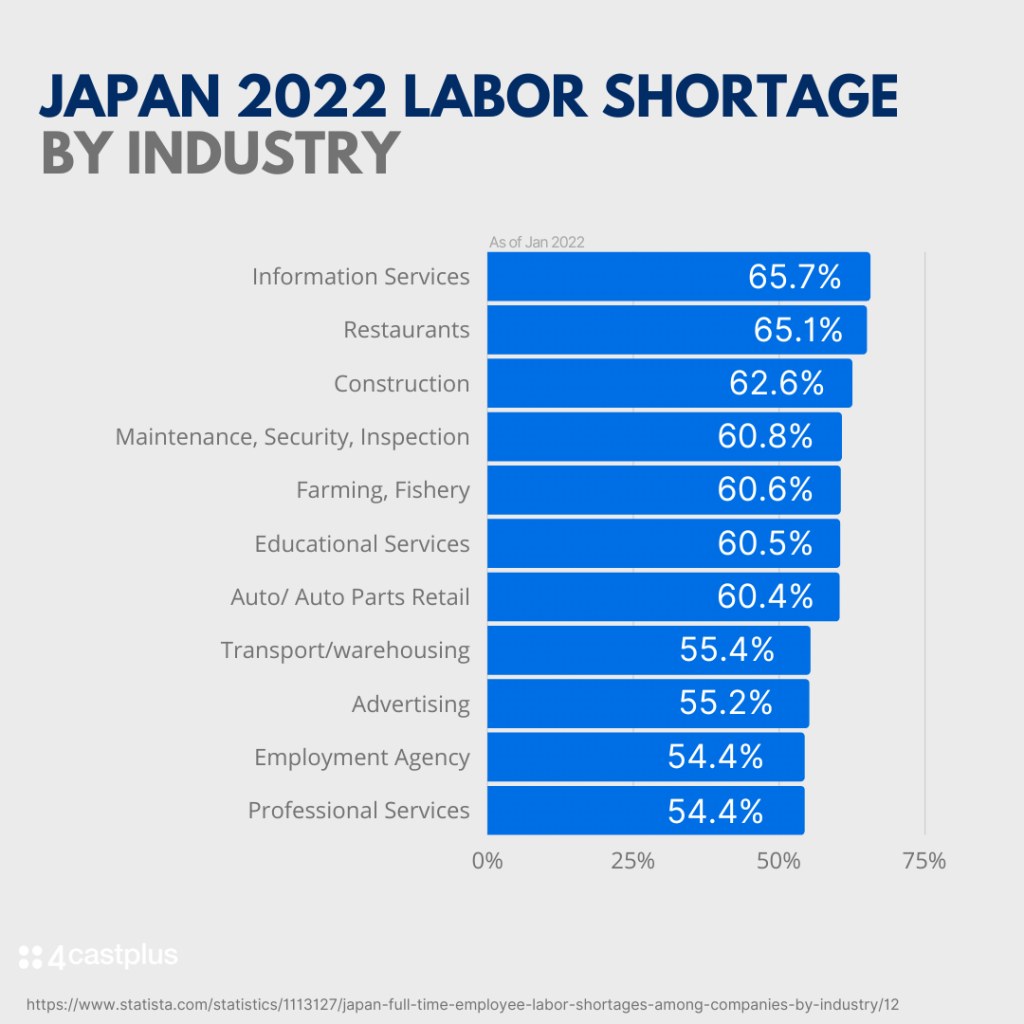

Japan is suffering a chronic labor shortage across a number of industries. Japanese economists believe this will further deteriorate with an aging population. Over 60% of construction companies in Japan reported that they were experiencing labor shortages. With an aging population, economists are concerned that Japan will not have enough workers to sustain the economic recovery needed to reach pre-pandemic levels.

What does this mean for the construction industry?

The global labor shortage has resulted in project delays and a significant rise in labor costs in the construction industry; coupled with other inflationary cost increases that have resulted in widespread financial and schedule challenges in commissioning new and existing projects.

- In Canada, large construction companies are facing the prospects of turning down work and addressing rising costs due to the labor shortage.

- According to the Associated General Contractors of America survey 88% of construction companies are experiencing delays, 61% of the time due to worker shortages, including sub-contractors. 89% of the same companies report difficulty filling positions due to lack of qualified workers.

Reduce Risk of Labor Shortages on Construction Projects

Labor shortages, inflation and supply chain constraints may be with us for a while, so putting practical solutions in place to best deal with it is critical for both contractors and owners.

Do More With Less

A key part of the solution for tackling a labor shortage is to leverage construction software that increases efficiency and eliminates an abundance of labor-intensive activities that can be offloaded to a software platform.

Construction software solutions are designed to take on the heavy lifting of project management, project controls, job costing, reporting and more. Eliminate redundancies such as rekeying data into multiple systems or wasting hours of valuable time fighting with spreadsheet errors, missing data, or information that’s out-of-date.

Rather than waiting for the labor shortage to end, construction contractors can take much of this into their own hands by onboarding critical software tools that maximize productivity and save precious resources and time.

Learn More about the 4castplus construction project solutions designed for businesses like yours. Find out how you can empower your teams with critical tools built to maximize the efficiency and effectiveness of your lean project teams.

Learn More

Maintain tight visibility and control on the costs, activities and productivity of all your subcontractors and suppliers. Materials management, equipment rentals, miscellaneous purchases and subcontracted services can all coexist together with full control over budget, accruals, project inventory and much more. There is no other software system on the market that provides such comprehensive procurement management for construction projects.

Platform

Platform Solutions

Solutions Owners

Owners Contractors

Contractors Engineering/EPCM

Engineering/EPCM Professional Services

Professional Services Resources

Resources White Papers

White Papers Case Studies

Case Studies Blog

Blog Videos

Videos Frequently Asked Questions

Frequently Asked Questions Company

Company About

About