Read In 16 Minutes

Driving Efficiency Through Enterprise Software Integration

Most organizations are rapidly digitizing all their operations to leverage the power and efficiency that software systems can bring to their business. There are clearly a wide range of software solutions fit for various purposes across the enterprise; and most modern systems today come equipped with an integration platform or API that enables bidirectional flow of key enterprise data between multiple systems. Integrating systems together has become a very popular way to onboard best-of-breed applications while maintaining the benefits of critical information moving seamlessly across business units and divisions.

It’s common practice for an integration strategy to leverage the ERP – or Finance system – as the core hub and system of record for most all enterprise data. It’s typical, for example, for data to originate in the software used by a business-specific area, and then feed that into the ERP on a regular synchronization. It doesn’t have to travel in this direction of course, since it’s also common for data to flow out of the ERP and into business-specific applications.

An example of data flowing in an integrated solution is the construction project management software used by the operational teams to oversee the successful and profitable delivery of projects large and small.

4 Key Benefits of Integrating Project Management with the ERP

Contractors, for example, will rely heavily on their construction software to manage large portfolios of major projects that have a significant financial footprint. The information collected and managed by the project controls and construction management software clearly needs to make its way to the ERP for processing of things like accounts payable, accounts receivable, payroll and more. Project controls systems are managing a tremendous amount of very granular data that’s being budgeted, tracked, forecasted and reported on at very high velocity of daily activity. Not all this data – at that level of detail – is of interest, or even relevant, to coexist in the finance system, so a key element to a successful integration is identifying which data, at which level of detail, is valuable to share between the systems. Equally important to the data granularity, is the direction of flow: as the System of Record, the ERP is typically the recipient of operational data collected and processed elsewhere in the organization.

Integrating systems does require time, cost and effort, so it’s important to understand why it’s worth it. Here I’ve highlighted a selection of 4 tangible benefits.

1. Eliminate Duplicate Effort and the Risk of Errors

Without an integration in place, a great deal of manual effort is required to rekey data from one system to another. This introduces errors, omissions and delays in crucial data being made available where it’s needed. A system integration can securely and accurately move information in near-real-time, eliminating the need for a labor-intensive process of doing it by hand.

2. Data Automation

Automating Accounts Payable (AP), Accounts Receivable (AR), and Payroll processes can significantly increase productivity across business units. Some organizations, for example, can receive 1000s of vendor invoices each week which all have to be attested, approved and put into the payables queue. If the AP data originates with the project management system, it needs to be managed with high efficiency and as much automation as possible to reduce cost, errors and delays.

3. Reduce Corporate Data Silos

When integrated information flows between divisions of the organization, it’s not just connecting the systems together, it’s also connecting the people that use those systems. This background communication tool serves to negate the effect of silos that can emerge between divisions. Silos are where communication breaks down, damaging efficiency, morale and collaboration.

4. Treating Information as a Critical Asset

“Data” is much more than numbers in a spreadsheet sitting on a shared drive. Data has value, especially when it can be mined, reported and analyzed in large, aggregated quantities. It’s when companies view their data as something of value that it becomes an asset. When that data asset is shared across enterprise systems, its value is then shared across corporate entities, bringing about tremendous decision-making power to multiple collaborative teams.

Learn More About Accounting Integration

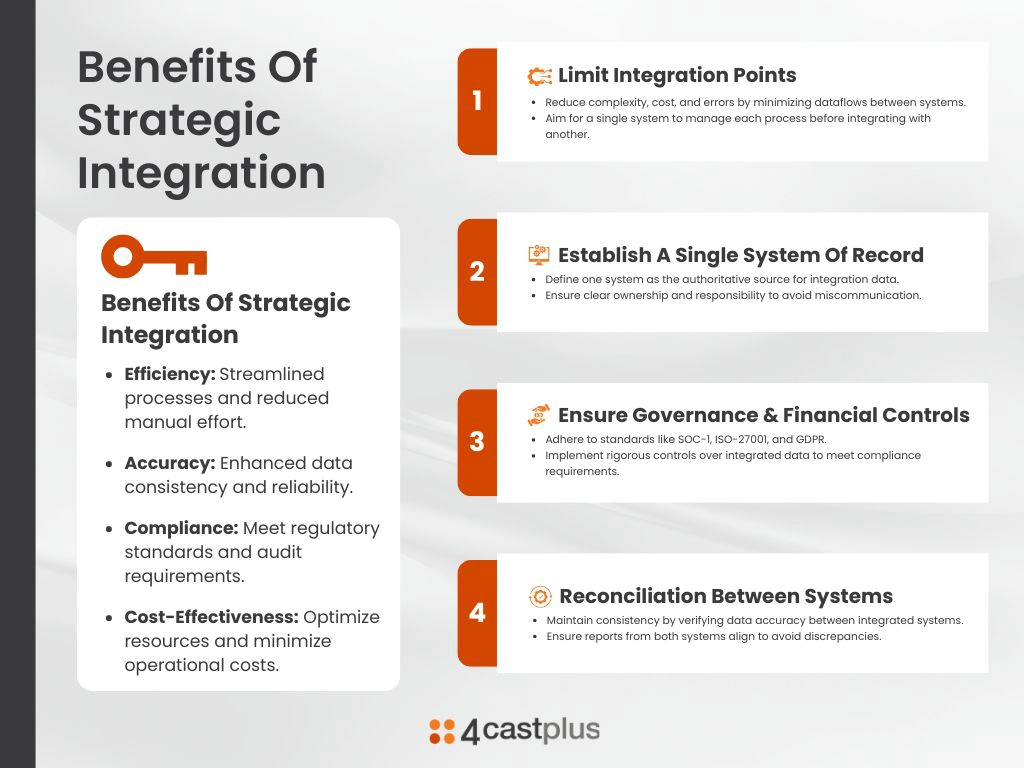

4 Important Considerations for a System Integration

There’s no question that system integrations can be complex. It’s important therefore, to plan appropriately and approach them strategically. At 4castplus, we recommend a cost-efficient integration that eliminates duplicate work and takes full advantage of the capabilities of both systems. Once in place, data will flow smoothly between the systems enabling a full enterprise view of corporate financial data. Following are 4 very key items to consider when planning out an integration.

1. Limit Integration Points

With any integration, it is important to reduce the number of interactions that occur between the two systems within the same business process. The more touch points (i.e.: dataflows) there are, the more complexity is introduced into the process in addition to cost, effort, and time. This leads to the potential for breaks and errors in critical processes. The goal should be that a single system should own as much of a process as possible before it can integrate with the second system.

2. Establish a Single System of Record

It is crucial that all integration data points between the two systems have an owner and a recipient so that there is no miscommunication or issues in integration. One system must be identified as the source of truth, and the other systems are deemed subscribers of the information. The business must initiate a system of record for these transactions and ensure that the business controls are established and can be reviewed and assessed to ensure that the process can support these audits.

3. Ensure Governance and Financial Controls

Another thing to consider is that leverage compliance standards such as SOC-1, ISO-27001, and GDPR are applied with strict governance and controls over all the data generated in the systems. In addition, apply the same level of meticulous management over the data set that is integrated with the ERP. The Chief Financial Officer (CFO), therefore, is provided with the peace of mind that all information is available for audit purposes, and subject to a demanding level of rigor.

4. Reconciliation Between the Systems

When one system is established as the system of record, and the second system receives the results and data of the integration flow, the second system must be able to reconcile back to the source system. Doing this will ensure that reports being generated from one system will reconcile with the second system and this will ensure data consistency.

Learn More

It is crucial to apply stringent measures and governance on these projects to ensure that your finances, activities, resources, and critical documents are carefully managed to decrease risk and provide a successful outcome. Working with 4castplus will equip you with a comprehensive cloud-based software platform on which your company can execute projects successfully, consistently, and profitably. Get in touch with us today to learn more about the ways we can assist with your construction company’s success. Or sign up for a free live demo to see 4castplus in action.

Platform

Platform Solutions

Solutions Owners

Owners Contractors

Contractors Engineering/EPCM

Engineering/EPCM Professional Services

Professional Services Resources

Resources White Papers

White Papers Case Studies

Case Studies Blog

Blog Videos

Videos Frequently Asked Questions

Frequently Asked Questions Company

Company About

About