Read In 5 Minutes

Mastering the Cash Flow Rollercoaster

A long time ago when I was first starting out in my career, an entrepreneur friend of mine told me about cash flow. “Cash flow is both your friend and your enemy,” he said. “It’s the angry gorilla at the door one day, then a beautiful spring morning the next.” At the time I was too novice and full of my own ambitions to really appreciate what he was saying. Since then I’ve grown up a little and faced the challenges myself of how cash flow swings can make or ruin your day. Eventually I came to understand that if you don’t have a good handle on your cash flow in business, you’re in deep trouble.

So, what does cash flow really mean? It seems so obvious on the surface: you have income and expenses, and cash flow is simply the intersection of the two. While this is fundamentally true, it’s a bit more complicated than that. Put simply, it’s the term used to define the highs and lows of available money as it flows in and out of a business or project (Wikipedia has a good description of cash flow). The big challenge with cash flow, however, is knowing when it’s going to be high and when it’s going to be low. It’s rare that there is a uniform, predictable ebb and flow of cash in any business, so having good information and tools to be able to calculate when those winters and summers are likely going to be, is crucial.

This is especially true of project-based organizations. When a contractor executes on a project, they will incur costs throughout the project and get reimbursed at certain milestones or billing cycles. There may even be times when there is a heavy upfront investment in materials or equipment, for example, that can take weeks or months to be fully reimbursed for – even if there’s an advance payment from the client. Even just covering payroll until receiving payments on invoices can send a company in the red for months into a project before breaking even. On top of that, having multiple projects on the go at the same time can further complicate the visibility into the overall corporate cash flow picture. Having a good read on how & when the money coming in from one project can help pay for the money going out on another project, can make or break a cash position.

Learn More About Finance & Cashflow Planning

Using Debt to Compensate for Cash Flow

When bidding on projects, there can be an amount of uncertainty that project managers and business owners struggle with if they’re not 100% confident they can actually afford to execute on that project until being fully reimbursed. This is such a common problem, that there has been an explosion of private debt financing companies that have emerged to offer a cushion to these project-businesses while they weather those uncertain days. Securing debt financing can obviously be a saviour for many businesses, but when taking advantage of a service like that, it’s critical for a business to have a solid handle on their current and historical cash flow so that they can: a) get a favorable rate and b) they can be sure it can be paid back while still being profitable. An even bigger question is, maybe they didn’t need financing in the first place. Many businesses get stuck in the rut of becoming too reliant on debt because they’re just not sure if they can cover the costs. And they’re not sure because they don’t have a good handle on their cash flow.

Project Cash Flow Forecasts

As a project cost management software solution, 4castplus has been designed to represent all project finances in terms of how they flow in and out of the project. It is intrinsically built around cash flow. This includes all revenue and expenses, which can be accounts payable, accounts receivable, payroll, budgets, forecasts, progress, etc. Fundamental to any project controls software, 4castplus merges the project budget with the project schedule, as a default behavior, to visualize the budget over a timeline.

Further to this, users can override the underlying schedule by applying “Time Phasing” algorithms to any workpackage, resource or collection of resources. Time phasing is the process of planning any item’s cost according to its anticipated cash flow. For example, if a subcontractor is going to be paid in 4 unequal milestones, with 60-day payment terms; that can be represented in the spend forecast through time-phasing. This would override the default prorated, linear spend forecast derived from the schedule.

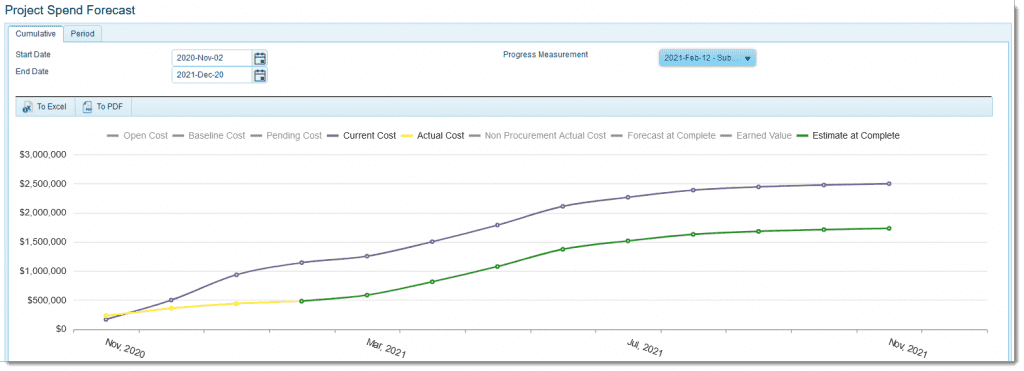

The chart in figure 1 below shows a project budget curve (in blue) alongside the actual cost (yellow) and estimate to complete (green). By providing visibility into the budgeted cash flow compared with the actual cost, users can get a clear picture of how the projected spend will play out. 4castplus also provides accounts receivable cash flow to visualize the intersection of cost and revenue to forecast a cash flow picture, giving the ability to anticipate where the project’s cash position is going to be at certain points in the future.

Anticipate Cash Position

That ability to anticipate – to foresee when the highs and lows are going to appear, along with how high and how low they’re going to be – is one of the most vital financial tools a company could possess. This is of course coupled with the solid financial metrics on where the project is at now, and where it’s trended historically. These 3-tiers of cash flow reporting provide a clear picture of a well-run organization.

Learn More

4castplus is brimming with features to provide your team with real-time visibility and oversight on budgets, forecasts, costs, contracts, accruals and more. Don’t let the complexity of construction projects limit your ability to make an impact. Contact us to learn more.

Platform

Platform Solutions

Solutions Owners

Owners Contractors

Contractors Engineering/EPCM

Engineering/EPCM Professional Services

Professional Services Resources

Resources White Papers

White Papers Case Studies

Case Studies Blog

Blog Videos

Videos Frequently Asked Questions

Frequently Asked Questions Company

Company About

About